The actual figure that constitutes a good coverage ratio varies from industry to industry. In other words, the current cash debt coverage ratio measures the entity’s ability to pay off its debts with the operating cash inflow it receives during an accounting period. A higher cash coverage ratio indicates that a company has sufficient cash flow from its operations to cover its interest expenses, reducing the risk of default on its debt obligations. In general, a cash coverage ratio of 1 or higher is considered satisfactory, as it indicates that a company can meet its interest payments without relying on external financing. However, it’s important to consider industry norms and a company’s specific financial situation when evaluating its cash coverage ratio.

What is a good current cash debt coverage ratio?

A higher cash coverage ratio indicates that the company has adequate resources to pay off its short-term obligations and is generally considered healthier than companies with lower ratios. Like other coverage ratios, the higher the cash coverage ratio is, the better it is for companies. A higher ratio indicates that a company has enough cash resources to satisfy interest expenses.

Why is EBITDA Used in the Cash Coverage Ratio?

The Cash Coverage Ratio uses EBITDA and focuses on cash interest expenses, while the Interest Coverage Ratio uses EBIT and includes total interest expenses, both cash and non-cash. However, if you have current debt and interest expense, calculating this ratio can be important, particularly if you’re looking to assume more debt with a large purchase or business expansion. Business owners should aim for a ratio of 2 or above, which means that interest expenses can be covered two times over. The owner would have to liquidate other assets to pay all her bills on time. Predictably, within months the restaurant goes bankrupt and closes its doors forever. Now, you must find a new tenant to lease the space, and you’ll probably absorb vacancy costs.

Our Services

It is also similar to cash debt coverage ratio, cash flow to debt ratio, and cash flow coverage ratio. We’ll address all of that in this article, along with formulas and calculations. The current cash debt coverage ratio is a quantitative value that gauges the liquidity of a company. The current cash debt coverage ratio should be used when analyzing a company’s ability to repay its current liabilities in the short-term (usually, within 12 months).

- This ratio helps investors and analysts assess a company’s financial health, solvency, and its capacity to honor debt payments.

- These figures should be visible on the balance sheet, and most businesses disclose them separately from other debt.

- A higher cash coverage ratio indicates that a company has sufficient cash flow from its operations to cover its interest expenses, reducing the risk of default on its debt obligations.

- The cash coverage ratio is calculated by adding cash and cash equivalents and dividing by the total current liabilities of a company.

Resources

Usually, stakeholders prefer the cash coverage ratio to be significantly higher than 1. A good coverage ratio varies from industry to industry, but, typically, investors and analysts look for a coverage ratio of at least two. This indicates that it’s likely the company will be able to make all its future interest payments and meet all its financial obligations. A cash debt coverage ratio of 1 or higher implies that the business is liquid enough to clear its debts on time. Companies need earnings to cover interest payments and survive unforeseeable financial hardships. A company’s ability to meet its interest obligations is an aspect of its solvency and an important factor in the return for shareholders.

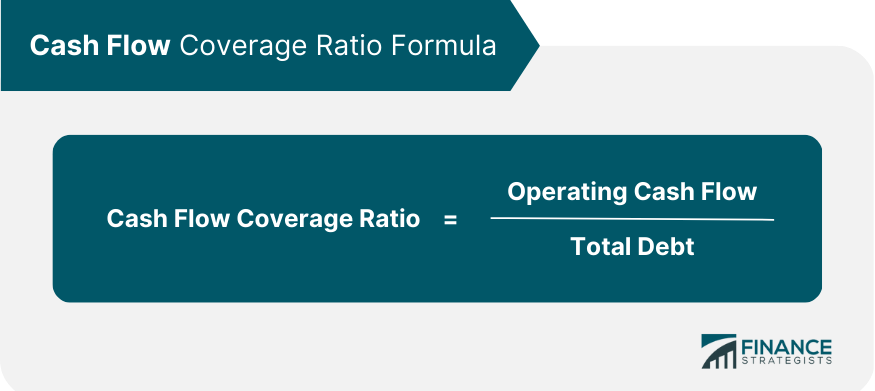

Cash Flow Coverage Ratio

The cash coverage ratio is a metric that measures a company’s capacity to pay down its liabilities with its existing cash. Only cash and cash equivalents are included in the cash coverage ratio. The cash flow coverage ratio shows the amount of money a company has available to meet current obligations. It is reflected as a multiple, illustrating how many times over earnings can cover current obligations like rent, interest on short term notes and preferred dividends.

The cash coverage ratio focuses on whether a company has enough cash resources to cover interest expenses. By understanding both cash coverage ratio and TIE ratios, investors can better assess whether or not a potential investment is right for them based on their risk appetite and goals. To calculate this ratio, you take the company’s operating income before tax and divide it by its nonoperating expenses, including interest payments and amortization costs over the same period. Companies can identify opportunities to improve their cash flows by calculating this ratio. The above formula uses a company’s total cash instead of earnings before interest and taxes. Similarly, it does not require companies to include non-cash expenses in the calculation.

However, there is an alternative formula for the cash coverage ratio. This alternative is more straightforward compared to the above option, as below. There may be a number of additional non-cash items to subtract in the numerator of the formula. For example, there may have been substantial charges in a period to increase reserves for sales allowances, product returns, bad debts, or inventory obsolescence.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Specifically, these include remodeling the place and installing newer cooking equipment. Therefore, the restaurant owner visits its local bank seeking a $500,000 loan. However, stakeholders must compare this information with similar companies to obtain better information. If a business you’re evaluating seems out of step with major competitors, it’s often a red flag.

The ratio might help you estimate your company’s capacity to repay loans. A tax calculator return and refund estimator 2020 of one indicates that the company has just enough cash to meet its present liabilities. Most organizations should aim for a cash flow ratio of at least 1.5x.